General Ledger Mapping

General Ledger Mapping is required to match TimeTrex Pay Stub Accounts to existing company ledger accounts.

The following steps describe how to map the general ledger accounts using a worksheet, created from existing pay stub data, to help simplify the process:

- Click Report, then click Payroll Reports and then General Ledger Summary in the main menu.

- In the Template field, choose 'Worksheet for General Ledger Mapping'.

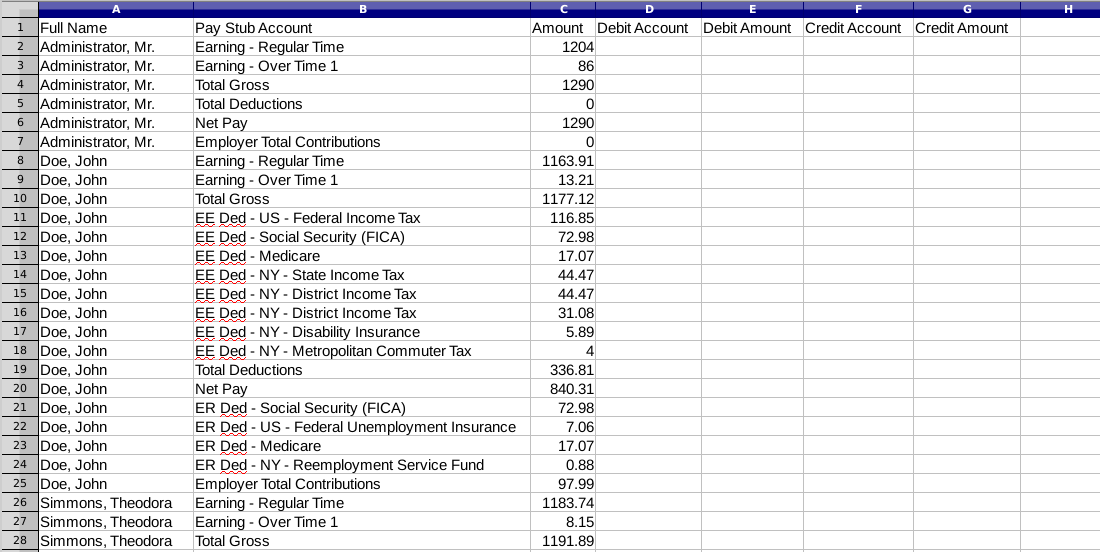

- Click on the View drop-down in the button bar and then click Excel to download the spreadsheet file. Open the file. The worksheet should look similar to the image below.

Worksheet for General Ledger Mapping:

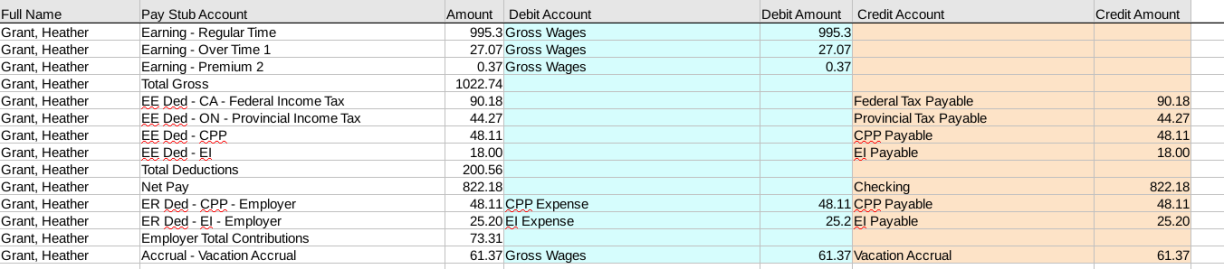

- Fill in the 'Debit Account' and 'Credit Account' columns on the worksheet with the ledger account names or account numbers that are applicable to the different pay stub accounts for each employee. For the exact ledger account names or numbers refer to a chart of accounts or trial balance report from your accounting software. The Total Gross, Total Deductions and Employer Total Contributions pay stub accounts add a number of accounts of the same type together and are rarely mapped. If a total pay stub account is mapped, then any pay stub account that is included as part of that particular total account should not be mapped to avoid duplicating amounts. To designate whether the ledger account is to be debited or credited, copy the corresponding dollar amount from the 'Amount' column into the appropriate 'Debit Amount' or 'Credit Amount' columns. Refer to either example of a completed worksheet below.

TIP: You may only have to fill in the worksheet for a few employees to include all the necessary pay stub accounts, if all or the majority of employees have the same pay stub accounts. When selecting just a few employees choose those employees that have the most number of pay stub accounts (rows) or those with unique pay stub accounts.

NOTE: Be aware that the account names or numbers must match exactly with the existing ledger accounts in the accounting software.

Example of a Completed Worksheet for General Ledger Mapping - United States:

Example of a Completed Worksheet for General Ledger Mapping - Canada:

- Once you have filled in the General Ledger Mapping Worksheet, add up the debit and credit columns to make sure the totals balance. Save the completed worksheet until you have verified the mapping process is correct.

- Click Payroll, then Pay Stub Accounts in the main menu.

- Select and edit each pay stub account by entering the ledger account names or account numbers from the Debit Account and Credit Account columns on your completed worksheet into the corresponding Debit Account and Credit Account fields. Review the pay stub accounts list, identify and edit any additional pay stub accounts that require mapping to your ledger accounts.

- To verify the account names or numbers have been mapped correctly and to confirm the debit total matches the credit total, view the General Ledger Summary Report by Employee.

For information about exporting from TimeTrex see General Ledger Export.