Pay Stub Transactions - Stop Payments

After a Pay Stub is generated, but prior to the associated direct deposit being received by the employee or a check being cashed, certain circumstances may make it necessary to process either:

To reissue a replacement check or direct deposit. TimeTrex automatically stops the payment and recreates another pay stub transaction for the same amount and the same payment method ready for processing again.

Use when:

- An issued check becomes lost.

- A check gets ruined in the printing process.

- A direct deposit ACH/EFT file gets lost,returned or rejected.

OR

To stop a payment and create a new pay stub transaction with a different amount or pay method from the original.

Use when:

The employee pay method for this particular pay stub was the wrong 'Type', i.e. Check rather than EFT/ACH (direct deposit).

The pay method amounts on the original transaction were incorrect.

- The bank returns a direct deposit for a reason such as, the bank account was incorrect or closed. In this case, corrections must be made to the Employees Pay Method before reissuing.

Process a Stop Payment - Reissue

This process reissues a payment transaction for the same amount and the same pay method as the original. If you need to make changes to the amount or pay method see Process a Stop Payment and Create a New Pay Stub Transaction.

To be able to make these adjustments, first ensure that the status for the specific pay period and pay stub(s) that will be affected are set as follows:

The Pay Period Status is either "Open" or set to "Post Adjustment".

The Pay Stub(s) Status is "Open".

Then follow the steps below:

Click Payroll, then Pay Stub Transactions in the main menu.

Select the specific pay stub transaction(s) you want to reissue.

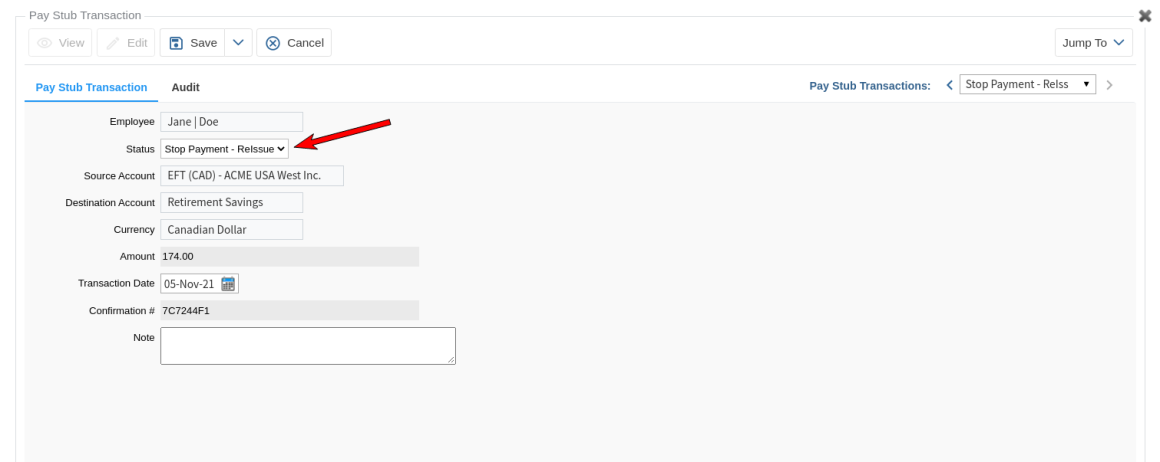

Click Edit in the button bar and change the status of the transaction to "Stop Payment - Reissue" .

Click Save in the button bar.

Click the Jump To button and click on Pay Stubs and then select the displayed Pay Stub(s).

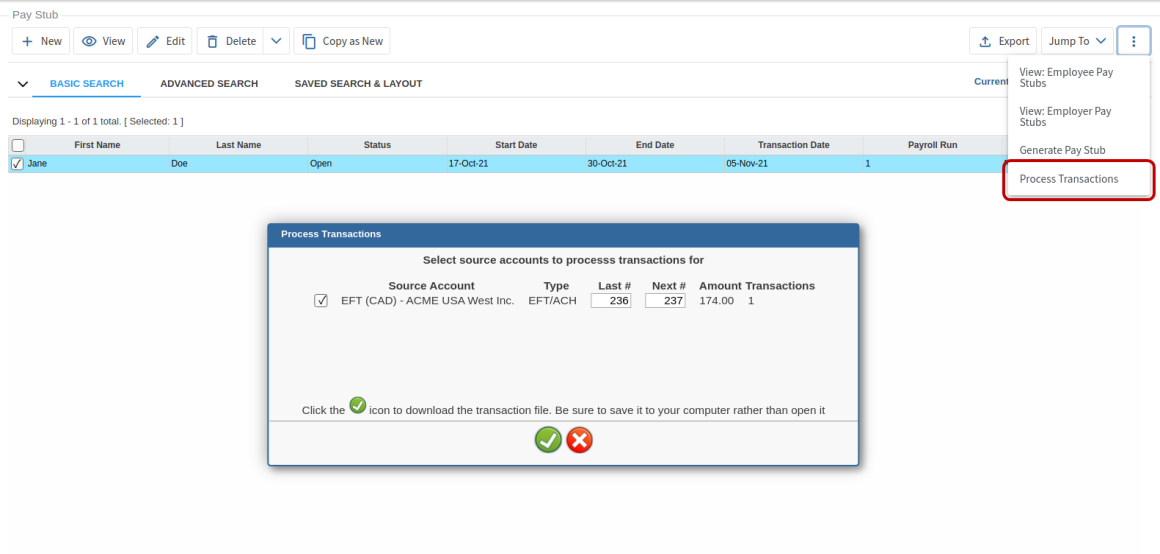

Click the three-dot More button

and click on Process Transactions, verify the transactions are what you expect and then click the green checkmark

and click on Process Transactions, verify the transactions are what you expect and then click the green checkmark  .

.You may now "Close" the Pay Period or edit the Pay Stub(s) and set the Status to "Paid" and then click, Save in the button bar.

Process a Stop Payment and Create a New Pay Stub Transaction

This procedure stops a payment and creates a new pay stub transaction with a different amount and/or pay method.

To be able to make these adjustments, first ensure that the status for the specific pay period and pay stub(s) that will be affected are set as follows:

The Pay Period Status is either "Open" or set to "Post Adjustment".

The Pay Stub(s) Status is "Open".

and

If necessary, the Employee Pay Method is corrected or a new pay method is added.

Then follow the steps below:

Click Payroll, then Pay Stub Transactions in the main menu.

Select the specific transaction(s) you want to stop.

Click Edit in the button bar and change the status of the transaction to "Stop Payment" and then click Save in the button bar.

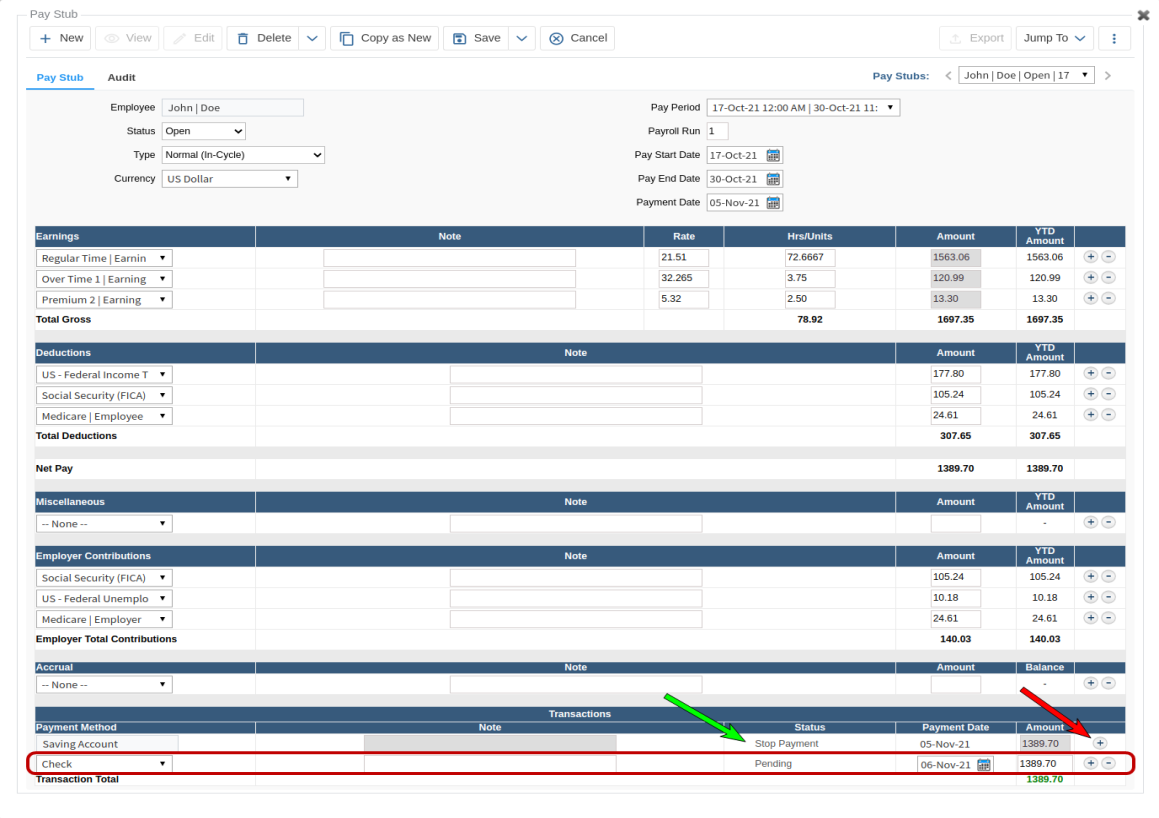

Click the Jump To button and click on Pay Stubs and select the displayed Pay Stub.

Click Edit in the button bar and then Edit in the sub-button bar in the details section on the Pay Stub tab.

In the Transaction section near the bottom of the screen, click the plus button ,

to add another transaction. (See the red arrow in the image below.)

to add another transaction. (See the red arrow in the image below.)Select the necessary Payment Method from the drop-down menu, enter the Payment Date and Amount then click Save in the button bar.

Click the three-dot More button

and click on Process Transactions, verify the transactions are what you expect and then click the green checkmark

and click on Process Transactions, verify the transactions are what you expect and then click the green checkmark  .

. You may now "Close" the Pay Period or edit the Pay Stub(s) and set the Status to "Paid" and then click Save in the button bar.